Berklee Consolidated Financial Statements: May 31, 2023, and 2022

Letter from the Interim Chief Financial Officer

Dear Berklee community,

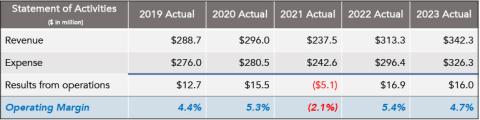

I am pleased to share that Berklee ended FY23 with a positive margin in unrestricted operations of $16 million, or 4.7 percent, which is above our annual targeted range of 2–4 percent. This margin was lower than the prior fiscal year (5.4 percent) by 70 basis points. The less favorable result owes to post-COVID economic inflation on operating, equipment, and materials costs, and the cap on new enrollment targets, offset in some measure by overperformance on continuing enrollment both year to year and from fall to spring.

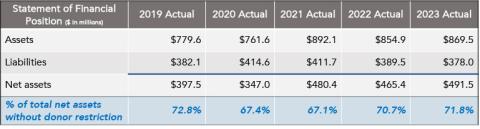

Similarly, Berklee’s endowment posted positive investment returns of $14.8 million (+3.65 percent) in FY23, in comparison to negative returns of $41.1 million (–9.20 percent) in FY22. This change was largely driven by market recovery. Turning to the balance sheet (next page), assets increased and liabilities decreased, resulting in growth to net assets of $26.1 million overall. Liquidity remained roughly level year over year (the sum of cash and short-term investments), impacted by draws related to the renovation of 12 Hemenway Street, student experience investments, and other capital renovation and repair costs deferred during COVID. Despite these additional capital expenditures, cash and cash equivalents increased $4.4 million from FY22. However, short-term investments increased $22.6 million above FY22. As mentioned above, the endowment performance was much improved this year. Bonds and notes payable were reduced by the scheduled amounts of debt service payments, resulting in an overall reduction in debt principal of $7.2 million from $244.7 million to $237.5 million.

In the statement of activities, net tuition and fees increased $27.6 million, while contributions decreased by $1.85 million. In expense, the cost of instruction has edged upward, fueled by post-COVID inflation and corresponding salary increases. The cost of academic support has also increased moderately due to post-COVID market-driven wage inflation and essential employee retention–related compensation increases. The cost of institutional support and advancement increased by $10.6 million; however, this figure also included several significant one-time institutional-level administrative expenses.

Depreciation and amortization increased year over year, owing to the recent execution and completion of significant capital projects to address deferred maintenance and the launch of student experience investments in FY23. Unrestricted net assets are 71.8 percent of the total, which is very positive compared to the majority of our peer institutions. This represents an increase of 80 basis points above the previous fiscal year. Berklee’s debt at the close of FY23 remains elevated compared to our A-rated peers, with $237.5 million in outstanding principal.

There were no new accounting pronouncements or material changes in the statements adopted in fiscal year 2023, and as mentioned above Berklee has received an unqualified opinion from its external auditing firm KPMG. We look forward to an exciting year ahead as we continue to provide high-quality education while enhancing the student experience.

View Berklee's consolidated financial statements.

F. John Case

Interim Chief Financial Officer